Sprive App Review & Referral Code (Pay Mortgage Faster)

Posted on

Have you tried Sprive?

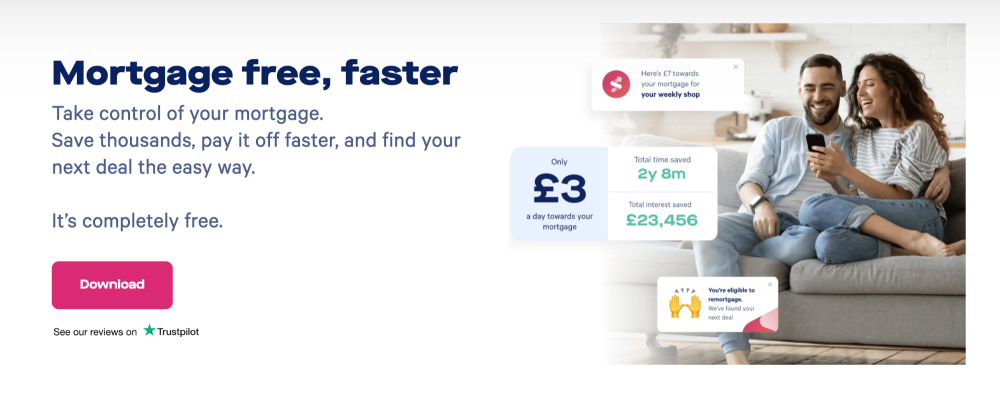

It’s a free app and it helps you put spare cash towards your mortgage so you can pay it off faster, potentially saving years off your mortgage term and saving up to thousands in interest.

I also have a Sprive referral code so you can get £5 for free!

The Sprive app is completely free to use. You can choose to withdraw the cash you save in the Sprive app either back to your bank account, or you can use it to overpay your mortgage at a click of a button.

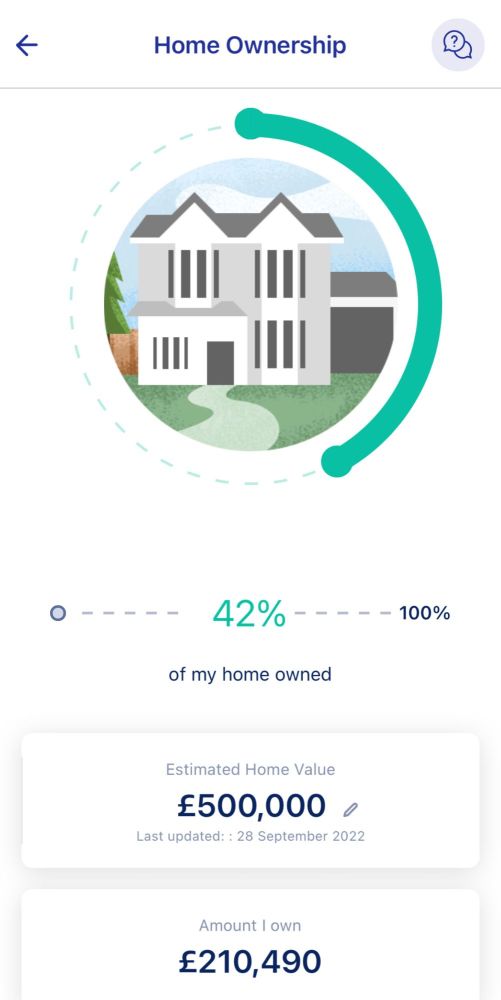

They have lots of other cool features such as seeing the best mortgage deal for that day with your current lender or with others. Also, you can see at a glance the percentage of your home that you own.

Read on to learn more about the Sprive free money offer, referral scheme and my personal Sprive review of its best features and why I like this app.

Just here for the Sprive referral code? Enter Sprive referral code 3OVDPUBK when signing up for a free £5 to get you started.

Click here to download the Sprive app today using my referral link!

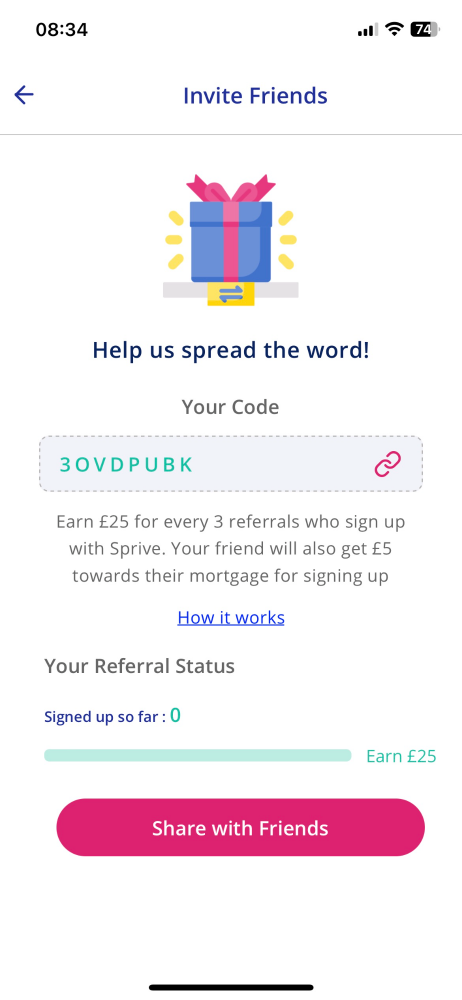

Sprive Referral Code £5 Free Cash

Join Sprive today!

Have you tried Sprive? It’s free to download and it helps you put spare cash towards your mortgage so you can pay it off faster and save interest.

Complete sign up with my code 3OVDPUBK and get £5 towards your mortgage!

Click here to download the Sprive app today using my referral link!

What is Sprive and how can it help me overpay my mortgage?

Sprive is a really simple and easy-to-use app with features designed to help you save money on your mortgage. It’s completely free to use.

So, how does Sprive work? Here's what you can do with the Sprive app to help pay your mortgage faster:

-

Sign up to Sprive by clicking here and entering Sprive referral code 3OVDPUBK for £5 free cash which you can send to your mortgage to get you started!

-

Autosave each month from your linked bank account and send to your mortgage with a simple click of a button (or withdraw the cash back to your bank account if you need it as it’s not automatically sent to your mortgage, you have to choose to send it from the Sprive app or you can withdraw)

- Set how much you want to autosave; I have mine set from £25 to £75 per month

-

Set an overpayment limit (handy if you can overpay your mortgage so much without fees e.g. 10% per year)

-

View live mortgage deals to see if you can save money on your current interest rate (updated daily!)

-

View your mortgage progress and date you’ll be mortgage free

-

View your loan to value

-

Easily see how much of your home you own (monetary and by percent)

-

Earn £25 per three friends you refer using your own Sprive referral link and code (sometimes they run special offers, such as earning £15 per friend referred)

-

You can access free independent advice in your Sprive account

- Buy discounted gift vouchers for supermarkets and top retailers via the Sprive app, then use the cashback received to pay even more off your mortgage via a click of a button in the Sprive app

They say “Sprive is a mortgage assistant that uses smart technology to help you be mortgage free, faster and helps you make sure you’re always on the best deal. You can use Sprive on your iPhone or Android smartphone.”

Click here to download Sprive today!

Is Sprive safe?

Is Sprive legit? Yes, Sprive is a safe app that does what it says. We've been using it in our household since 2022 and everything has been fine.

It is regulated by the Financial Conduct Authority (FCA), which means that it has to meet certain standards of security and privacy. Sprive also uses bank-level security to protect your data.

According to their terms and FAQs:

"Sprive Limited is also a registered agent of Prepay Technologies Ltd which is authorised by the Financial Conduct Authority under the Electronic Money Regulations 2011 (FRN: 900010) for the issuing of electronic money."

"If you have an e-money account, then the funds in your account are stored and protected. With an e-money account, your money is never invested or loaned out and is safeguarded in accounts that keep your money separate from the money we use to run Sprive."

Overall, Sprive is a safe and secure app that you can use to overpay your mortgage. If you are concerned about the security of your data, you can always contact Sprive's customer support team for more information.

Is Sprive app free?

Yes, the Sprive app is completely free to use. There are no hidden fees or charges.

Get £5 free cash by signing up with my Sprive referral code

Complete sign up with my Sprive referral code 3OVDPUBK and get £5 free cash towards your mortgage.

My free money was available in the app within around 20 minutes of signing up.

I was told I’d have to wait for my first overpayment to be taken (£25 from my bank to Sprive app), but the free £5 was sent shortly after I signed up for the app.

I chose to send my free £5 to my mortgage and it showed on my mortgage account around 3 days later.

Click here to download Sprive today!

Pay extra off your mortgage with the Sprive refer a friend scheme

This offer is subject to change, but the current referral offer is ‘Refer 3 friends and earn £25’.

Each referred friend will get a Sprive sign up bonus of £5 free cash if they use a referral code when signing up!

When you refer a friend with your code they’ll get £5 in the app towards their mortgage. For every 3 friends that you refer, you'll get a £25 reward which you can withdraw or send to your mortgage.

The same is actually true with the money saved in Sprive towards mortgage overpayments - you can choose to use it to overpay the mortgage at a click of a button, or you can withdraw it to your bank account.

Sprive Rewards: Get instant cashback on gift vouchers and pay your mortgage off even faster!

Another great feature is the cashback feature called Sprive Rewards, allowing you to purchase gift vouchers with instant cashback.

This cashback goes into your Sprive account and can be used to pay extra towards your mortgage or transferred to your bank account.

The Sprive cashback you receive varies based on the brand and the amount you spend. Sprive has teamed up with many popular High Street names and supermarkets including Amazon, Morrisons, Just Eat, Waitrose, Costa, John Lewis, M&S, Deliveroo and many more.

To start earning, connect your Sprive account to your credit or debit card. After that, whenever you shop with a participating brand, you'll automatically receive cashback. You can easily keep an eye on your cashback balance using the Sprive app.

The cashback will go into your Sprive account, mine has always been within 10 minutes or so, and then you can send this cashback to your mortgage if you like, at a click of a button to reduce your interest even more and pay your mortgage slightly faster!

I use the Sprive app to regularly buy supermarket vouchers to do our monthly food shops. I then use the cashback to overpay our mortgage, helping to reduce the overall interest we will pay on our mortgage, and to help pay it even quicker!

Click here to download Sprive today!

Sprive review: things I like about the Sprive app

Here I'll share my Sprive review with you and the reasons why I recommend this mortgage overpayment app.

There are lots of features I really like about this app. Mostly, I like how I can visulaise my home ownership in a simple image that shows me exactly how much of my home I own.

With just an annual statement from my mortgage lender and an app that simply shows every payment, it’s sometimes feels like I’m getting nowhere with our mortgage payments and being able to fully own our home. (A 30 year mortgage doesn’t really help with that!)

We plan to really start overpaying our mortgage. It will be great to see our progress more clearly on the Sprive app to visualise our goal.

The Sprive app also shows just how much time can be saved on the mortgage term and how much interest can be saved by keeping up with the regular overpayments on the app.

There’s no commitment though. All money saved on Sprive isn’t automatically sent to your mortgage lender. Instead, you can choose when to send it with a simple click of a button. Or if you need the money back, you can choose to withdraw it back to your bank account with a click of a button too.

The overpayments that are saved to Sprive can also be paused, so there’s no pressure there either.

It’s also really quick and easy to sign up. It finds your mortgage by checking your credit report, from the personal details you provide, so you don’t have to scurry around trying to find your mortgage number or anything like that! I did check mine to make sure they had the right one before I sent my first overpayment and it was fine.

The Sprive sign up bonus and referral scheme are great too. You can get free £5 cash simply for signing up with my referral code!

Complete sign up with my Sprive referral code 3OVDPUBK and get £5 free cash towards your mortgage to kickstart your mortgage overpayment goals.

Click here to download Sprive today!

Roundup of Sprive app pros and cons

The Sprive app is designed to help you save money by overpaying your mortgage. It's free to use on both iOS and Android devices.

To get started with Sprive, connect your bank and mortgage accounts within the app. Complete sign up with my Sprive referral code 3OVDPUBK and get £5 free cash towards your mortgage.

Sprive uses your spending data to figure out how much extra you can pay towards your mortgage each month. Once set up, you can schedule regular payments from your bank account to Sprive, which will then be used to make overpayments on your mortgage.

In addition to this, Sprive offers several useful features:

- Track your progress towards becoming mortgage-free.

- Switch to a more favourable mortgage deal.

- Earn cashback while shopping with certain brands.

Sprive is regulated by the Financial Conduct Authority (FCA), ensuring your financial security.

For a quick-look Sprive app review, here are some of the main advantages and disadvantages of using Sprive:

Pros of using Sprive:

- User-friendly

- No cost involved

- Regulated by the FCA

- Helps you save on your mortgage

- Provides features for tracking progress and payment reminders

Cons of using Sprive:

- Requires linking bank and mortgage accounts which some people may not be comfortable with

- Overpaying might not be feasible for everyone

In summary, Sprive is a great option if you're looking to make mortgage overpayments and save money. It's secure and easy to use. But remember, your personal circumstances should guide your decision to use the app.

Sprive Trustpilot: What are customers saying?

On 1st Sepetmber 2023, Sprive has a Trustpilot rating of 4.6 out of 5 stars, based on 27 Sprive reviews. Of these reviews, 26 are 5 stars and 1 is 1 star.

The negative review suggests someone had money taken from their account after cancelling, however we do not know the full details of this feedback. Sprive did respond and for any queries or issues they can be contacted directly via email at [email protected].

In my own experience, whenever I have emailed Sprive, maybe three or four times, they have always responded very quickly via email.

The positive reviews for Sprive mostly praise the app for being easy to use and helpful. Some of the positive reviews say:

"We've been using the Sprive app to make overpayments for over a year. It's so much better than making overpayments via my bank. I'm also loving the new features they've added."

"If you’re looking to save money on your mortgage then Sprive is a no brainer."

"I can’t tell you how much I love the Sprive app. It’s so easy to use and is saving me a ton of money on my mortgage."

Overall, the Trustpilot Sprive reviews are highly positive!

Check out the latest reviews for Sprive on Trustpilot.

Final word on Sprive mortgage overpayment app

The Sprive mortgage app is a great app with a great aim - helping people to realise the potential of overpaying a mortgage even by just £25 per month. It really can make a big difference in reducing the overall interest and length of mortgage term.

Being able to visualise how much of your home you own and how long it will take to be mortgage free are also great incentives to make overpayments and become better financially.

It's also so easy to sign up, you don't need your ID or to spend ages entering information as they'll automatically get your mortgage details from your credit report.

It's so fast to sign up, plus you can use my Sprive £5 referral code to get you started.

Don’t forget to signup with my Sprive referral code!

Complete sign up with my Sprive referral code 3OVDPUBK and get £5 free cash towards your mortgage to help towards your mortgage overpayment goals!

Click here to download Sprive today using my referral link!

Want more freebies and free money?

If you love this Sprive £5 free money offer, then I have loads more referral codes and promo codes for you to get free cash other apps and websites.

Check out our articles on 80+ ways to get free money and plenty of other real ways to make money from home for free.

Also, for the savvy foodies... how to get free food!

Don’t forget to subscribe to the newsletter for the best free money offers, money-making and money-saving tips we discover!