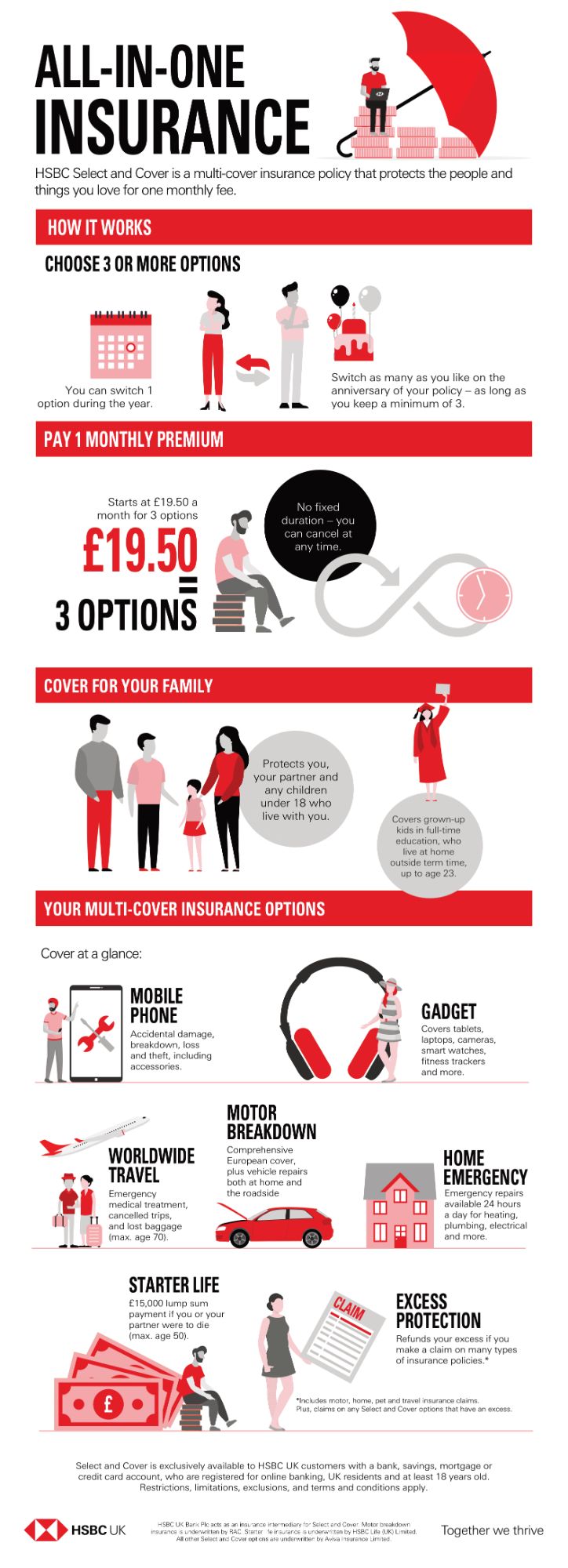

Make insurance easy for your family with HSBC Select and Cover

Posted on

Ad. Article in collaboration with HSBC. Posted 10.08.2021.

HSBC Select and Cover can help make insurance easier for you with a choice of cover options

One thing I’ve always thought is how it’s crazy we need so many different insurance policies with several monthly payments to different providers.

Wouldn’t it be easier if we could get a multi-cover insurance for all the lifestyle insurances we need from one provider? One simple monthly payment to one provider and one renewal every year. It makes more sense to me anyway!

Luckily, for HSBC customers with online banking, there is a solution for several common lifestyle insurances with the HSBC Select and Cover all-in-one insurance. For one monthly fee you can add three or more insurance options to cover your household.

Select and Cover offers one simple monthly payment for many of your family’s lifestyle insurance needs

HSBC Select and Cover is a multi-cover insurance policy that can be adapted to suit your family’s needs. For one monthly fee you can pick and mix three or more insurance options to make sure your family is covered for the things that matter.

Aiming to take the hassle out of buying various lifestyle insurances for you and your family, HSBC Select and Cover offer one monthly premium for your entire household family for several insurance options. ‘Family’ includes your partner and any children under 18 who live with you. Plus, any children under 23 who are in full-time education, but are at home outside of term time.

There are currently seven types of cover. The insurance options are:

- Mobile Phone: Up to four claims a year for lost, stolen or damaged phones.

- Gadget: Up to four claims a year for gadgets including laptops, headphones, games consoles and smart watches.

- Worldwide Travel: HSBC Select and Cover offers cover for coronavirus-related travel disruption. The travel insurance will also protect for lost or stolen baggage and other travel related instances. Cover is provided for those up to 70 years of age.

- Motor Breakdown: Roadside assistance and vehicle repairs on the road, at home or even in Europe if you breakdown. Any car that you or your family are travelling in!

- Home Emergency: Covering problems with plumbing, heating, gas, roof, drains and wiring.

- Starter Life: If you or your partner dies, you will receive a fixed lump sum of £15,000. If one of your children dies, you will receive £5000. Covers you up to the age of 50.

- Excess Protection: A refund of any excess you have to pay to make a claim either on Select and Cover or another policy you have including motor, travel, home or pet.

Terms, conditions, exclusions and limitations apply.

HSBC is for your household family, not just you!

One amazing benefit of HSBC Select and Cover is you only have one monthly payment to cover you, your partner and any children under 18 who live with you.

It also covers any of your grown-up children, up to the age of 23, if they are in full-time education and live with you outside of term time.

That’s pretty amazing as I know when our kids are older we’ll all have iPhones and gadgets in and out of the house which will cost a small fortune to replace if they break, making the mobile phone and gadget insurance really appealing.

Plus, there’s a worldwide travel insurance option and breakdown cover, which I think is a pretty nifty way to cover entire households with older teenagers who have their own cars.

How much does HSBC Select and Cover cost?

At the time of writing (June 2021) the monthly premium for three options is £19.50. You can add more options if required. Here are the pricing options:

- £19.50 for 3 options (£234 a year)

- £26.00 for 4 options (£312 a year)

- £32.50 for 5 options (£390 a year)

- £39.00 for 6 options (£468 a year)

- £45.50 for all 7 options (£546 a year)

Select and Cover is exclusively available to HSBC customers aged 18 and over who reside in the UK. You must have a bank, savings, mortgage or credit card account with HSBC to qualify.

Oh, and you must be registered for online banking, so register now if you haven’t already!

HSBC Select and Cover can change to suit your family’s needs

Insurance policies tie you in for a year or have exit fees should you wish to cancel before a full year, but HSBC Select and Cover has no fixed duration. You can cancel at any time. You just won't be able to repurchase Select and Cover for 6 months after you cancel.

You can also adapt the policy to suit your needs. Each year you can add and remove one option if your circumstances change and you require a different insurance product. Great for things like pandemics when your travel plans are put on hold and you don’t require travel insurance for a while!

On the anniversary of your policy you can change as many things as you like. The only requirement is you keep at least three types of cover at all times

Get rewarded for choosing Select and Cover

At the time of writing you can also get rewarded when you sign up to Select and Cover online. Here are the rewards you can currently choose from:

- 3-month baking subscription

- Tracking device for your keys and wallet

- £40 Argos eGift Card

Please note, this offer could be withdrawn at any time.

Tell me more!

For more information and to learn how useful this insurance is for your family, visit the Select and Cover page at HSBC.

Select and Cover is exclusively available to HSBC customers with a bank, savings, mortgage or credit card account, who are registered for online banking, UK residents and at least 18 years old.

HSBC UK Bank Plc acts as an insurance intermediary for Select and Cover. Motor breakdown insurance is underwritten by RAC. Starter life insurance is underwritten by HSBC Life (UK) Limited. All other Select and Cover options are underwritten by Aviva Insurance Limited.

Check out this handy infographic from HSBC which explains how Select and Cover works and the types of insurance you can include:

More great blog posts:

- Tops tips on how to manage your loan repayments to improve your financial situation.

- Check out these smart ways to use a credit card to reap the rewards and avoid debt.

- At what age should you get life insurance?

- Want to manage your finances better? Here are loads of family finance tips and helpful debt articles.

- Looking for more ways to save money? Check out my massive money saving tips section and find some great deals on my UK voucher codes and free money pages!